3DS

3DS is a security protocol used to authenticate users to protect card-not-present transaction scenarios against fraud, stymie unauthorized transactions, and reduce chargebacks.

Versions

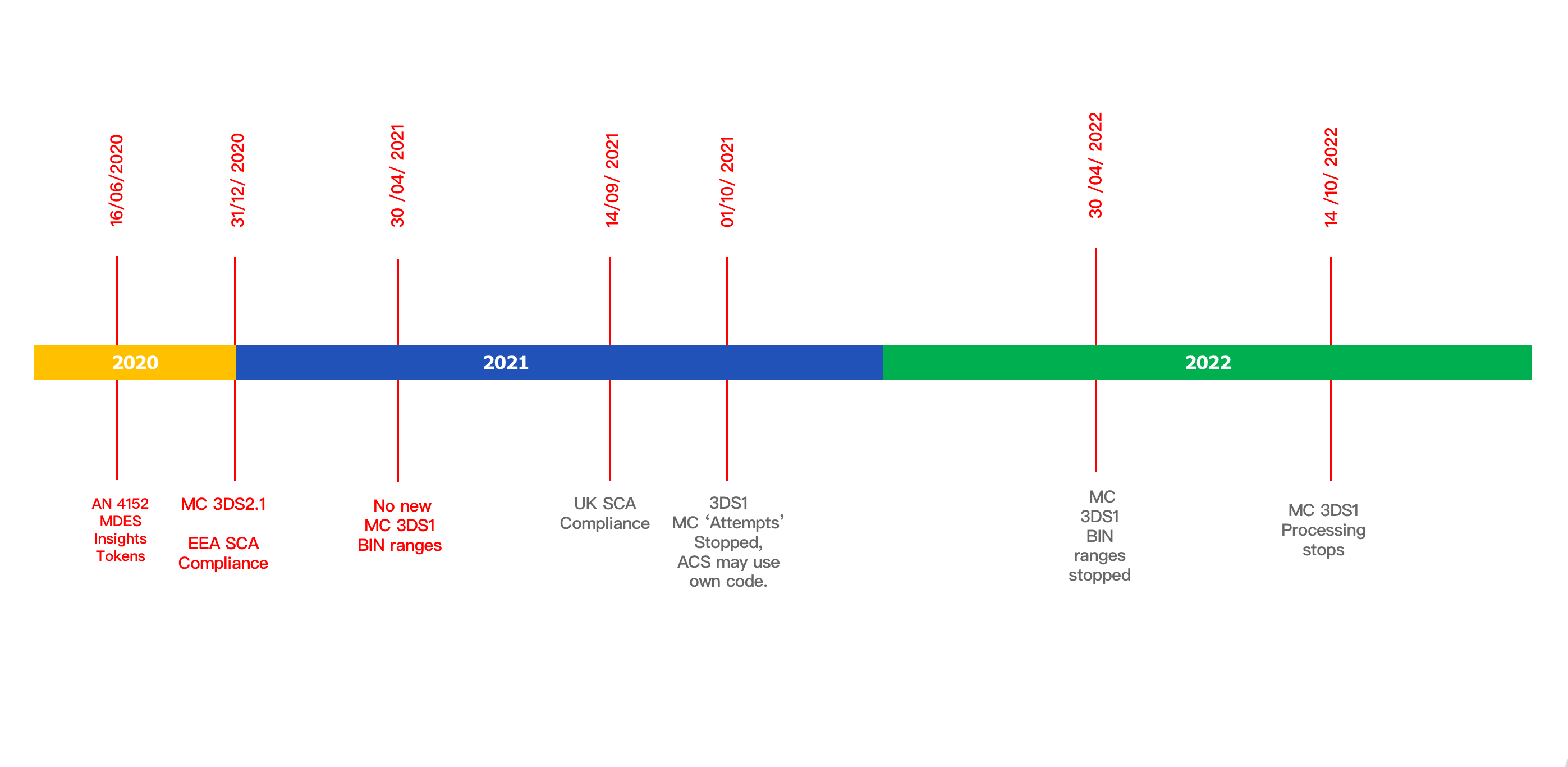

- 3DS 1 Outdated - See roadmap below

- 3DS 2.1 Partially implemented

- 3DS 2.2 🌟 New

How it works

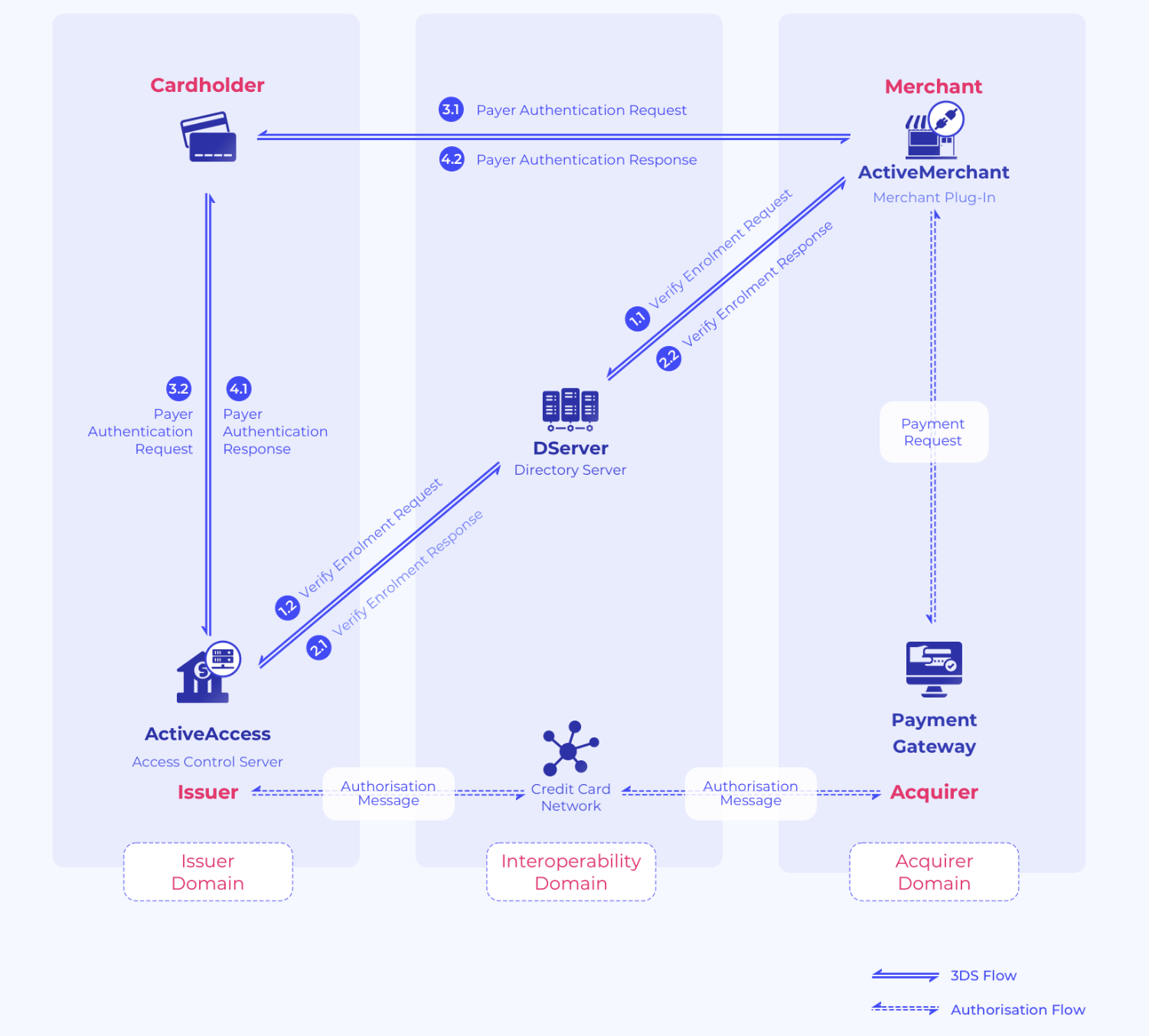

3DS Authentication flow

Source: gpaymentsopen in new window

Source: gpaymentsopen in new window

Differences

3DS1 vs 3DS2

3DS1 Features

- Support with dynamic linking

- Basic two-factor authentication

3DS2 features

- 3DS2 improves on 3DS1 with more data points that can be used to evaluate the risk level of a transaction

- Achieves Frictionless flow, that is,

- Better UX (User Experience) since 'trusted' parties don't have to authenticate each time

- Soft declines on transactions with context as to what business rule was not met an allowing the customer to reauthorize rather than restart the transaction

- Aligned to SCA therefore is more secure necessitating 2FA

3DS2.1 vs 3DS2.2

While both 3DS2.1 and 3DS2.2 support Frictionless flow, 3DS2.2:

- allows the merchant to request additional exemption through the Acquirer (Delegated Authentication)

- enables Decoupled Authentication where 2 different devices are used to complete the process

As Tutuka, we already partially supported 3DS2.1 for you to build on. Recently we've added a feature-set incorporating 3DS2.2. More about this in the release notes.

3DS1 and 3DS2 Roadmap

Key: (Consult our Glossary)

- MC (MasterCard)

- MDES (Mastercard Digital Enablement Service)

- BIN (Bank Identification Number)

- SCA (Strong Customer Authentication)

- ACS (Access Control Server)